capital gains tax indonesia

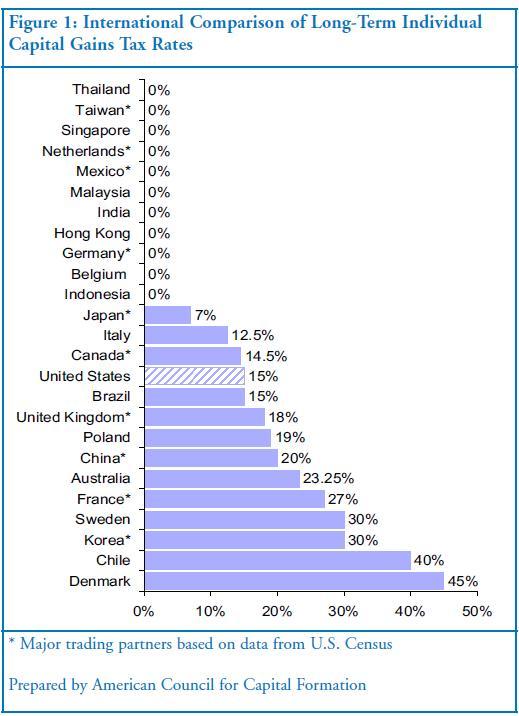

In arriving at effective capital gains tax rates the Global Property Guide makes the following assumptions. CGT is often associated with buying and selling property but it can also apply to other kinds of assets including.

Why Indonesia Should Raise The Income Tax Of The Ultra Rich Individuals

The exceptions are sale of land and buildings and exchange-traded shares ie.

. In 1999 the Spanish government modified the regulations governing the municipal capital gains tax the tax paid when selling a property and since then foreigners not resident in Spain have been. Gains on shares listed in Indonesia are taxed at 01 final tax of the transaction value. Indonesia plans to charge value-added tax VAT on crypto transactions and capital gains at a rate of 01 starting May 1.

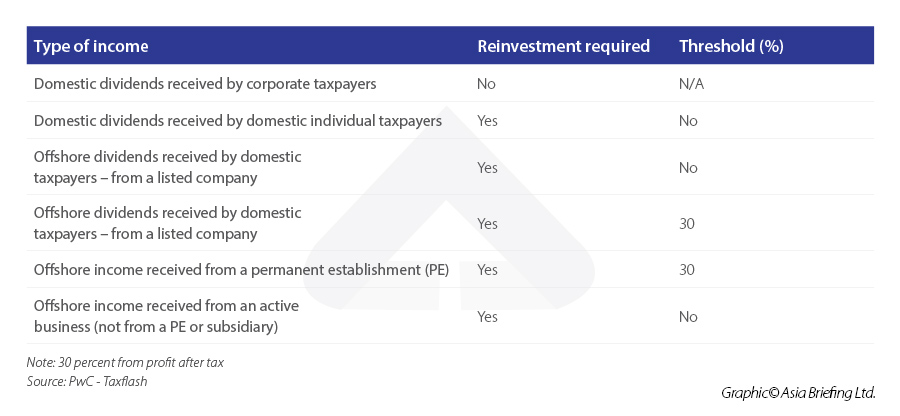

Nonresidents are taxed at a flat rate of 20. In Indonesia the main differences among acquisitions made through a share deal versus an asset deal are as follows. Capital gains - Capital gains derived by an individual are taxed as income at the normal rates.

An additional tax of 05 applies to. The property is directly and jointly owned by husband and wife. 26 WHT of 20 is applicable.

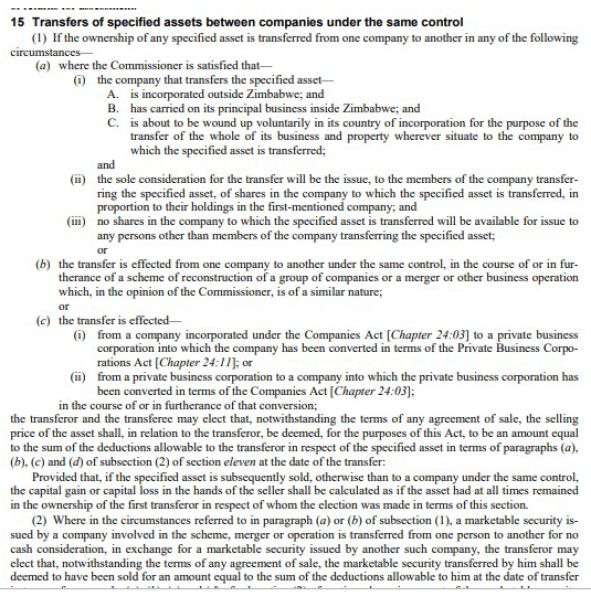

The settlement and reporting of the tax due is done on self-assessed basis. A tax resident is generally taxed on worldwide income although this may be mitigated by the application of double taxation agreements DTAs. The transfer of titles to land and buildings under an asset purchase subjects the seller to a 25 percent final income tax and subjects the buyer to a 5 percent transfer of title tax duty.

Conversely a capital loss occurs when you sell an asset for less than what you paid. Indonesia continues its serious efforts to promote foreign investment as well as domestic investment capital accumulation and. Capital gains are generally assessable together with ordinary income and subject to tax at the standard CIT rate.

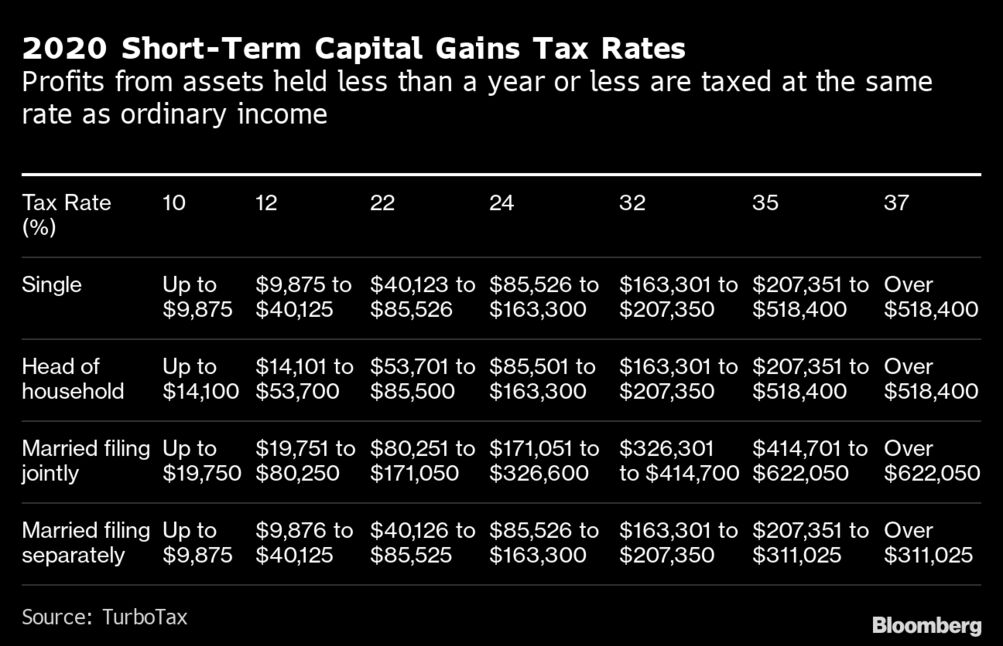

Indonesia Highlights 2022 Page 2 of 10 Corporate taxation Rates Corporate income tax rate 22 Branch tax rate 22 plus 20 branch profits tax in certain circumstances Capital gains tax rate 22 standard ratevarious Residence. For the transfer of unlisted shares 25 capital gain tax due on net basis will apply for the Indonesian tax resident seller. Listed on the Indonesian stock exchange given that these are subject to final tax at the point of sale see Property taxes and Sale of shares taxes in the.

Sedangkan investasi jangka panjang dalam barang koleksi dikenai pajak pada flat 28. Article 2326 Income Tax PPh 2326 Domestic Article 23 WHT is payable at the rate of 2 for most types of services where the recipient of the payment is an Indonesian resident and 15 for a variety of payments to resident corporations and individuals. VAT on the export of taxable tangible and intangible goods as well as export of services is fixed at 0 percent.

However the exact rate may be increased or decreased to 15 percent or 5 percent according to government regulation. Indonesia which consists of 17508 islands and approximately 270 million people is the worlds fourth-most-populous country. If the seller is non-Indonesian tax resident a 5 capital gains tax final due on the gross transfer value which has to be.

It is their only source of capital gains in. It is also the worlds third-largest democracy and the worlds largest archipelagic state. 34 Capital gains taxation 35 Double taxation relief 36 Anti-avoidance rules 37 Administration 38 Other taxes on business 40 Withholding taxes 41 Dividends 42 Interest 43 Royalties 44 Branch profits tax 45 Wage taxsocial security contributions 46 Other 50 Indirect taxes 51 Value added tax 52 Capital tax 53 Real estate tax.

Even gains made on the disposal of shares in a land-rich private Indonesian company are taxable in Indonesia only if the Singapore seller owns 50. However gains from the transfer of land and buildings are not subject to regular CIT but rather are subject to final income tax at a rate of 25 of the transaction value or the government-determined value whichever is higher. Share deal Capital gains received by an entity in a share deal are subject to corporate income tax of 25 while capital gains received by an individual are subject to individual income tax in the range of 5 until 30.

Generally the VAT rate is 10 percent in Indonesia. Indonesian tax residents are required to file annual individual tax returns when their total income derived from sources within and outside of Indonesia exceeded the minimum threshold which is between IDR54000000 for a single individual and IDR72000000 for a married individual with three childrendependents effective 1 January 2016. Capital gains taxes.

The new capital gains tax article has made it explicit that the taxing rights relating to any gain on the disposal of shares in non-land-rich private. From property situated in Indonesia. Capital gains tax also known as CGT is a type of tax paid when you sell an asset for more than you bought it for.

However the Omnibus Law has added a provision to the Income Tax Law stipulating that foreigners who have become domestic tax subjects by reason of becoming tax resident in Indonesia can be taxed only on. Taxable income - Taxable income of individuals includes profits from a business employment income and capital gains. What is capital gains tax.

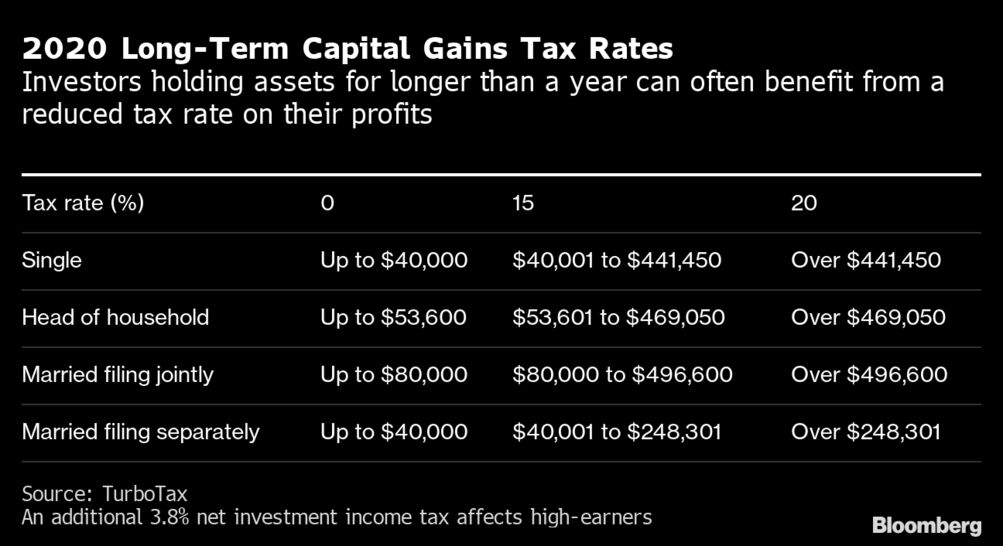

Di tahun 2015 capital gain jangka panjang dikenakan pajak yang bermacam-macam mulai dari 0 untuk pajak penghasilan 10 dan 15 15 untuk pajak penghasilan 25 sampai 35 atau 20 untuk 396 pajak penghasilan. A company is regarded as Indonesian tax resident if it is established or domiciled in Indonesia or if its place of. The sale of shares listed on the Indonesian stock exchange is subject to a final tax at 01 percent of gross proceeds.

The rental income of nonresidents is taxed at a final withholding rate of 20 of gross income. Double-taxation agreements between Indonesia and other countries may reduce this to 10. Capital gains are generally assessable at ordinary tax rates together with other income of the individual.

They have owned it for 10 years. The valued-added and capita-gains taxes will take effect on May 1.

A Tax Dilemma How Capital Gains Can Hold Financial Advisors Hostage Nasdaq

Mengenal 5 Jenis Pajak Di Indonesia Beserta Contohnya Income Tax Filing Taxes Capital Gains Tax

Robinhood Investors Confused Over How Much Tax They Must Pay For Trading Stocks Bloomberg

Taxation Of Investment Income Within A Corporation Manulife Investment Management

Capital Gain Tax Stock Photos Royalty Free Images Vectors Video Capital Gains Tax Capital Gain Tax

Capital Gains Tax Capital Gains Tax Zimbabwe

Forex Trading Academy Best Educational Provider Axiory

What Is Long Term Capital Gains Tax The Financial Express

What Are The Changes In Tax Treatment Under Indonesia S Omnibus Law

Obama Should Leave The Capital Gains Tax Rate At 15 Seeking Alpha

Top 8 Things To Know About Taxes For Expats In Indonesia

Long Term Capital Gains Vs Short Term Capital Gains And Taxes Nasdaq

Capital Gains Tax Would Buffett Prefer To Live In Holland

Indonesia To Impose Vat Income Tax On Crypto Assets From May Reuters

Why Indonesia Should Raise The Income Tax Of The Ultra Rich Individuals

Indonesia To Impose Vat Income Tax On Crypto Assets From May Reuters

Robinhood Investors Confused Over How Much Tax They Must Pay For Trading Stocks Bloomberg

Taxation Of Investment Income Within A Corporation Manulife Investment Management